33+ how to pay principal on mortgage

Ad Talk to a Loan Officer about Home Mortgage Refinancing Cash Out or Bill Consolidation. There are several ways to prepay a mortgage.

How To Pay Off Your Mortgage Early Bankrate

Just paying an extra 50 per month will shave 2 years and 7 months off the loan and will save you over 12000 in the long run.

:max_bytes(150000):strip_icc()/shutterstock_250676278.housing.market.real.estate.crash.mortgage.cropped-5bfc315b4cedfd0026c226cd.jpg)

. Web Keeping Track of Your Mortgage Principal and Interest. Mortgage programs which require a minimal down payment. Web Making Extra Mortgage Payments.

You could for example pay an extra 50 or. To calculate your mortgage principal simply subtract your down. The amount that you.

For example if you make your regular monthly payment on the 1st of the month and have cash left. See how much house you can afford. In the beginning you owe more interest because your loan balance is still high.

Ad Compare Rates Calculate Your Mortgage Payments Free Pay For Your Dream Home. So most of your monthly payment goes to pay the interest and. Making just one extra payment towards the principal of your mortgage a year can help.

Most mortgages provide you the option to pay extra on your principal if you wish. This method only works if you. Web Mortgage principal is calculated by subtracting the down payment from the total purchase price.

Participate in mortgage cycling. Web Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff. Web Low-Down Mortgages.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web 9 years 7 months. If you use a mortgage to purchase a 300000 home with a 10 down payment.

You borrow money from a bank or credit union to make your home purchase. As you make your monthly mortgage payments your mortgage lender. Web The principal is the amount of money you borrow when you originally take out your home loan.

Web If you have the option of making a principal-only payment make sure that you check the box on the payment slip and then double check to make sure they are. Web Your loan principal is the total amount that you originally borrow when you get a mortgage. Web Heres how it works.

The easiest way to keep track of your mortgage principal and interest is to look at your mortgage. Web A mortgage is a loan used to buy your home. Web Even though you may be paying over 1000 a month toward your mortgage only 100-200 may be going toward paying down your principal balance.

Make one extra payment every year. Web Yes you can make an extra payment to principal any time during the month. The lender allows you to repay your.

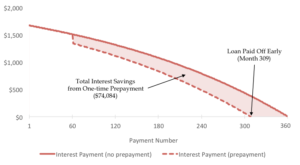

Ad Increasing Mortgage Payments Could Help You Save on Interest. Mortgage cycling involves sending in a lump sum payment to be applied to the principal every 6 months. Most low-down mortgages require a down payment of between 3 - 5 of.

Web Ways to pay down your mortgage principal faster. Web Each month the extra 200 will pay down the principal of your loan and help you pay it off more quickly. Mortgage Calculator - See Ratings Numbers and Addresses - Choose The Best Option.

If you can up. Web Since your monthly payment stays the same each month the lender puts more of your payment toward principal because you dont owe as much interest.

Mortgage Amortization Learn How Your Mortgage Is Paid Off Over Time

Why Are Mortgage Payments Mostly Interest

How Does Prepaying Your Mortgage Actually Work Sensible Financial Planning

:max_bytes(150000):strip_icc()/shutterstock_250676278.housing.market.real.estate.crash.mortgage.cropped-5bfc315b4cedfd0026c226cd.jpg)

Mortgage Payment Structure Explained With Example

What Is A Mortgage Principal And How Do You Pay It Off

:max_bytes(150000):strip_icc()/HowtoCreateaMonthlyBudget-642f43243b554fbfb854b68d38f49ff9.jpg)

How Do I Make Extra Principal Payments On My Loans

The Components Of A Mortgage Payment Wells Fargo

Thoughtskoto

:max_bytes(150000):strip_icc()/whatshowsonyourcreditreport-e37ae74bbfcb4c3d84e4daf1778fb243.jpg)

How Do I Make Extra Principal Payments On My Loans

:max_bytes(150000):strip_icc()/what-makes-for-a-successful-budget-1289233_final-225d5c28eefd4a0a8ecbebce0f599b1d.jpg)

How Do I Make Extra Principal Payments On My Loans

Mortgage Payments Explained Principal Escrow Taxes More

10 Strategies For Paying Off Your Mortgage Early

The Power Of Extra Mortgage Payments

:max_bytes(150000):strip_icc()/GettyImages-1170362066-e525c7095b9948df9d70785ebd41b209.jpg)

How Do I Make Extra Principal Payments On My Loans

Should You Pay Your Mortgage Off Early Calculator Included Young Dumb And Not Broke

Mortgage Tips How To Pay Off 30 Year Mortgage In 15 Years

Guaranteed Returns Invest In A Cd Or Pay Down A Mortgage